Welcome to our comprehensive guide on car insurance costs! Whether you’re a seasoned driver or a newcomer to the road, understanding the factors that typically influence the cost of car insurance is crucial for making informed decisions about your coverage.

In this article, we delve into the key elements that insurance providers consider when determining your premium. From your driving history and vehicle type to geographical location and coverage preferences, we’ll explore the myriad aspects that play a role in shaping the financial aspect of your auto insurance.

Stay tuned as we unravel the intricacies of car insurance pricing, helping you navigate the road to optimal coverage at the best possible rates.

What are the usual factors that affect the pricing of car insurance?

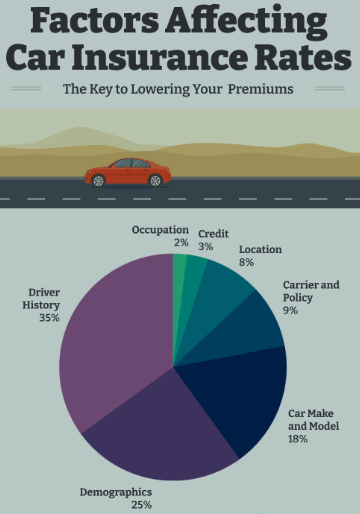

The typical factors influencing car insurance prices include your driving history, vehicle type, location, coverage preferences, and deductible choices.

Navigating the Maze of Car Insurance: 25 Factors that Shape Your Premium

Car insurance, a mandatory financial safeguard for every vehicle owner, can be a complex maze of factors that influence its pricing. Understanding these factors is crucial for making informed decisions and potentially securing lower premiums. Let’s delve into the 25 key elements that shape your car insurance costs:

Driver-Related Factors

| Driver-Related Factors | Description |

| Driving Record | Your driving history serves as a predictor of future risk, with a clean record lowering premiums and a tarnished one raising them. |

| Age and Experience | Younger drivers, typically with less experience, face higher premiums due to perceived inexperience. As experience accumulates, premiums tend to decrease. |

| Gender | While gender-based pricing is declining, statistical trends suggest women generally pay lower premiums than men. |

| Marital Status | Married drivers often enjoy lower premiums, as insurance companies perceive them to be more responsible and settled. |

| Occupation | High-risk occupations may result in higher premiums, reflecting the potential for increased accident risk. |

| Credit History | In some states, credit history can influence premiums, as insurance companies view good credit as an indicator of responsible behavior. |

Vehicle-Related Factors

| Vehicle-Related Factors | Description |

| 1. Car Make and Model | Sports cars, luxury vehicles, and high-performance models typically incur higher premiums due to their perceived higher repair and replacement costs. |

| 2. Car Safety Features | Vehicles equipped with advanced safety features, such as anti-lock brakes, airbags, and lane departure warning systems, may qualify for lower premiums. |

| 3. Car Usage | Driving frequency and purpose play a role in premium pricing. Vehicles used for commuting or pleasure may have lower premiums than those used for business or delivery. |

| 4. Coverage Selections | The type of coverage you choose, such as comprehensive, collision, or liability, significantly impacts premiums. Comprehensive and collision coverages typically have higher premiums than liability coverage. |

| 5. Deductible Amount | The deductible is the amount you pay out-of-pocket before insurance coverage kicks in. A higher deductible lowers premiums but increases your upfront costs. |

Location-Related Factors:

Location:

Urban areas with higher crime rates and accident frequencies often have higher premiums compared to rural areas.

Garaging:

Parking your car in a secure garage can lower premiums as it reduces the risk of theft or vandalism.

Miles Driven:

Annually driven miles are considered when setting premiums, as higher mileage increases the risk of accidents.

Anti-Theft Devices and Discounts

| Anti-Theft Devices and Discounts | Description |

| 1. Anti-Theft Devices | Installing anti-theft devices, such as alarms or immobilizers, can lower premiums by deterring theft. |

| 2. Discounts | Insurance companies offer various discounts based on factors such as good driving records, multiple policies, occupational affiliations, and membership in certain organizations. |

| Additional Considerations | Description |

| Insurance Company | Different insurance companies have varying pricing strategies and risk assessments, so shopping around can yield significant savings. |

| 2. Insurance Regulations | State-level insurance regulations can influence premium pricing, making it essential to understand local policies. |

| 3. Policy Changes | Regularly reviewing and updating your policy to reflect changes in your driving habits, vehicle usage, or address can impact premiums. |

Conclusion

Car insurance premiums are shaped by a complex interplay of factors, including driver characteristics, vehicle attributes, location-based risks, anti-theft measures, and discounts.

By understanding these factors and making informed choices, you can navigate the car insurance maze and potentially secure lower premiums while maintaining adequate coverage.

I’m Farhan Hakeem, a passionate automotive enthusiast and the driving force behind . With a deep-rooted love for cars and an unquenchable curiosity about the world of automobiles, I’ve embarked on a journey to share my insights, experiences, and opinions through this platform.

From a young age, the mesmerizing blend of artistry and engineering that cars embody captivated my imagination. Over the years, I’ve honed my understanding of automotive technology, design, and trends, which I now channel into creating engaging and informative content.